Digitisation and efficiency in tailored financial services

An investment thesis

By Fortitude Investment Partners

Overview

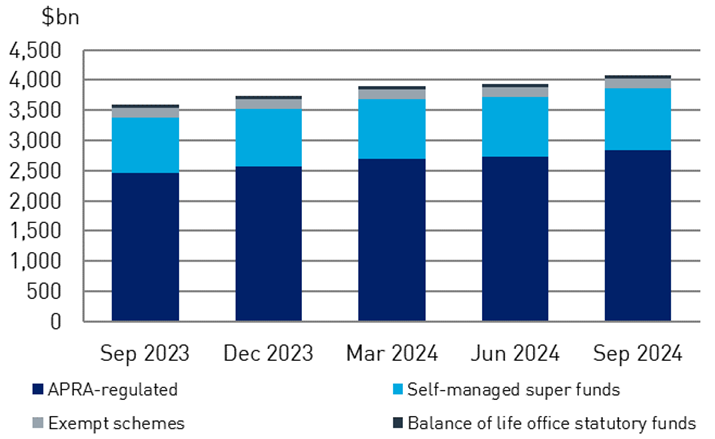

Australia has one of the largest retirement capital systems of any country in the world. On its own, the Australia superannuation system is the fourth largest savings pool in the world, with $3.9 trillion under management1. Despite this, Australians are largely not receiving high-quality personal financial advice, as the cost and accessibility of unique, tailored financial advice and associated reporting requirements make it complex for a large portion of the market. Only ~11% of Australian households receive annual personal financial advice2.

Some investors who are seeking a more personally tailored approach to portfolio construction and allocation consider Self-Managed Super Funds (SMSFs). As of 2024, only ~5% of Australia’s population is a member of an SMSF3, despite their ability to enable investment strategies more tailored to the uniqueness of individual circumstances.

SMSFs have historically been costly and complex to manage, and investors have been reticent to actively participate in their management. Recent enhancements in technology are enabling more automated investment decisions, reporting and auditing for SMSFs and other investment vehicles in Australia. We at Fortitude believe organisations facilitating this increase in efficiency of advice and reporting will enhance the proportion of investors who can access more tailored investment strategies through SMSFs and similar.

Chart 1: Assets of Superannuation Entities

Source: APRA

This presents significant opportunities for an investor like Fortitude.

Lack of access to personal financial advice in Australia

The recent Royal Commission into the Misconduct in the Banking, Superannuation and Financial Services Industry has resulted in a range of changes to the Financial Planning and Wealth Management industry. These changes include additional education requirements and changes to fee models. Large banks have exited the market prior to and during the royal commission given these points and pressure on investments required for new platforms and challenges to vertical integration. Significant numbers of practitioners have also left the market, with the number of registered financial advisers in Australia having declined through to 2023.

Chart 2: Number of financial advisers in the market

Without change, we expect this will continue to drive an increase in participation in industry superannuation funds, as has been the case for the last 5 years. The mega funds have taken an increasing share of AUM over the period (noting some of this consolidation has been driven by M&A).

Chart 3: Assets under management of mega funds

Source: Super Insights Report 2024

Technology is driving efficiency

At Fortitude, we believe that these dynamics present interesting investment opportunities:

Technology to enable efficiency of access – Technology can be used to enable more efficient allocations of portfolios, whilst enhancing reporting, auditing and compliance requirements. This is expected to lower costs of access, further increasing access to the above.

Removal of scale players and therefore opportunity to build scale in financial planning & wealth management – the industry has seen the removal of slow moving, large, often conflicted, legacy providers (such as banks) in the provision of financial advice. The industry is now more fragmented, with a large number of smaller providers of financial advice, despite the increasing benefits of scale of practices in uses of technology and profitability.

Tailored advice and product requirements – The proliferation of different types of advice requirements and the requirement for advice to be more personalised and tailored to each investors’ requirements. New, often unique products are becoming more available, often outside of large superannuation funds, which may be more applicable to the uniqueness of investor circumstances.

The early signs that investors are prioritising unique and tailored financial advice, allocations and compliance through SMSFs has been seen in a recent uplift in SMSFs.

Chart 4: Total Number of SMSF

We consider each of these themes in more detail, noting we believe the interesting niche areas; often overlooked by others, represent the most compelling investment opportunities.

We also note that recent regulations are seeking to enhance access to financial advice by removing red tape and expanding access to retirement income4. We assess that this is positive to our themes.

At Fortitude, we believe that these dynamics present interesting investment opportunities.

Technology to enable efficiency of access

Given the costs incurred to manage an SMSF, trust, company or similar vehicle, technology advancements are being created to reduce the implementation, transactional and compliance burden. We believe this presents considerable opportunities in niche areas:

Live links between banking platforms and reporting programs enable more efficient reporting. This provides opportunities for enhanced reporting and insights. Various technology-enabled service providers enhance this efficiency.

Annual auditing requirements for an SMSF in Australia have historically been costly. Given the relative consistency of the audit enquiries, innovative businesses are developing technology-enabled compliance and assurance reviews. We believe this niche lends itself to dominant providers given efficiency and the market niche.

The older, larger participants often have legacy systems that make it much harder for them to adapt and innovate, paving the way for new market entrants to take share with a superior value proposition.

Removal of scale players and therefore opportunity to build scale

Several consolidators have emerged in wealth management and financial planning, driven by the following dynamics.

- Superior margins in larger practices – In large practices, profit per owner is on average $809,163 as compared to $252,969 for smaller practices. These often have higher confidence to recruit and train support staff, with 1.8 support staff per adviser as compared to 1.5 support staff in smaller firms5.

- Opportunities for consolidation – Almost 45% of financial planning firms in Australia generate less than $500k in revenue, with ~70% being single principal, often with limited succession plans.6

- Possible return of the banks – Despite banks having exited for the time being, we assume there is a likelihood that they will return in the next ~5 years7. Large financial institutions in Australia have moved in and out of financial advice several times over the past 50 years. This may mean different approaches for different participants. We have a view that building a high-quality consolidator in financial planning with superior technology and margins will become interesting for banks and / or other consolidators in ~4-5 years’ time.

Tailored advice and product requirements

Generational change in Australia in the next ~20 years is expected to transition considerable wealth from baby boomers (who have in a large part generated material wealth from property accumulation in Australia) to generations X, Y and Z. Younger individuals have typically been less likely to receive financial advice given they have less wealth to justify the investment in appropriate advice8. We believe this may change as they inherit proceeds from the baby boomers.

Younger investors are more interested in investing in “ESG forward” investment products, as they seek to have their capital make a positive impact8.

Chart 5: ESG Investing Generation Gap

Source: Stanford

New products are being created, which are often more complicated to access through mega fund platforms. These include Pearler, Raiz Invest and Equitise10.

Risks and challenges

While the industry dynamics and emerging technologies in tailored financial services present significant opportunities, there are also inherent risks and challenges that need to be considered. These include regulatory uncertainties, policy changes, technological risks, and market volatility. Additionally, the innovation response by mega funds may pose challenges for certain industries and strategies.

Underwriting risk and opportunities to create value within the tailored financial services segment involves all the usual due diligence considerations. But experience suggests that it also requires paying extra attention to several critical factors, such as:

Regulatory risk – Regulation or policy changes, including changes to the delivery of financial advice and ongoing compliance, have and are likely to continue to occur.

Market risk – New players and competitors will be drawn to lucrative opportunities, increasing competition. Fortitude is certainly not the only investor seeking exposure to this thematic and we see value in moving quickly to capitalise on market trends, focusing on the niches with market leaders.

Technology risk – Impact and disruption from technology improvements, and how likely those impacts are.

Opportunities to Invest

Fortitude Investment Partners believes that the Tailored Financial Services is an attractive thematic in which to invest. We are well placed to look at opportunities that exist well beyond the scope of traditional large lenders and platforms that have attracted the most attention.

Why?

We have:

An established operating partner network with significant experience across the financial services industry,

10+ years experience in investing in the lower mid-market private equity market, and

investigated 100+ businesses across the tailored financial services thematic.

Would you like to know more?

References

- Organisation for Economic Cooperation and Development (OECD), OECD Pension markets in focus: Preliminary 2022 data, September 2023, p225 and World Development Indicators database, World Bank, 1 July 2023.

- NGM Consulting

- Australian Taxation Office (Superguide.com.au)

- Ashurst - Treasury releases roadmap for financial advice reform packages

- Macquarie AFS Benchmarking report

- Business Health

- Investor Daily - NAB Contemplates return to financial advice arena amid proposed changes Money Management - Expect digital advice to prompt return of banks

- Stanford - ESG Generation millennials boomers split their investing goals